Can I secure my assets from creditors by making a belief? Sure, a pension protection system is a kind of have faith in that will help safeguard retirement assets from creditors.

A couple preferred to achieve a joint once-a-year Internet revenue of £seventy five,000 through their retirement, and tax competently pass on their estate for their small children. Perspective Start off planning early

In 2025, affluent retirees encounter an significantly sophisticated money landscape. Protecting and developing wealth now needs a multifaceted tactic, and the stakes are significantly large when working with considerable assets, elaborate relatives structures and evolving financial aims.

Asset protection is frequently A final-moment or non-existent believed for A lot of people. It truly is hence important to safeguard your assets upfront. A proper plan will allow you to to maintain your Way of living and go your assets on to your heirs or charitable businesses.

Updating beneficiary designations and looking at umbrella coverage policies are crucial actions to guarantee retirement assets remain secure and therefore are passed on In accordance with 1's wishes.

Putting alongside one another a workforce of advisers to aid with coverage, taxes along with other fiscal difficulties can assist with security, progress and reassurance.

Selected states, however, allow the marital residence to have a “tenants-by-entirety” title. Which means that creditors can not normally get joint assets to be able to pay off a person wife or husband’s obligations.

Using this type of in your mind, people today need to remain vigilant within their asset protection procedures and fiscal planning, making sure relief and stability throughout their retirement several years.

The initial dialogue and creation of the wealth approach are complementary for top Web really worth clients, if you end up picking to take a position with us any updates in your system will even be no cost. Exactly what are the advantages of cashflow planning services?

The mixed initiatives of insurance policies, legal and tax pros allow a thorough asset protection technique tailor-made in your Main and secondary residences, even should they’re Situated in numerous states or utilized for rental needs.

One of many most significant advantages of right beneficiary designation is always that it permits retirement assets to bypass probate. Probate is a lengthy and often expensive lawful procedure that could hold off the distribution of money and expose assets to creditors.

Rigorous economical planning and tax management methods can mitigate the possible affect of those debts in your retirement funds, ensuring a far more secure fiscal future.

Domestic Asset Protection Trusts (DAPTs): DAPTs are specialized trusts specially made for asset protection, shielding personal and Experienced assets from prospective creditors. By transferring assets into a DAPT, individuals can Restrict additional reading their exposure to economic and legal risks though retaining Handle around the management of the assets in the have confidence in.

Both medical pros and entrepreneurs are exposed to unique dangers inside their respective professions. In excess of ninety eight% advice of surgeons will deal with no less than one particular malpractice claim by the point they turn sixty five.

Michael Bower Then & Now!

Michael Bower Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Mike Vitar Then & Now!

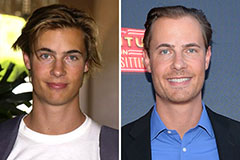

Mike Vitar Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!